Majority of the students studying accounting, either at initial stages or experienced in accountancy academics, are familiar with two of the most renowned depreciation methods used by entities to calculate depreciation expense for the period are straight-line and declining balance methods.

One of the reason why these methods are so widely used is the fact that these are not only recognized and allowed by different accounting frameworks (accounting standards frameworks) around the world but in many countries taxation and other regulations require entities to strictly use any of these two methods to compute depreciation expense pertaining to an accounting period.

However, with the advancement in the accounting knowledge, many depreciation models and techniques have been developed to achieve accuracy of financial and accounting data so that users of financial statements can reach better economic decisions.

One of such derivation or method to calculate depreciation is declining balance with straight line crossover or simply declining balance with cross-over. In short form it is usually mentioned as DBX or db x sl. It is also known as variable rate declining balance method or variable declining balance method.

Under this method, asset is initially depreciated using declining balance method but after a certain point the depreciation method is switched from declining balance method to straight line method of depreciation computation.

The certain point when depreciation method is changed or switch-over is made or cross-over occurs according to the policies or whenever it is thought to be feasible and it is up to entity’s management to determine when such cross over or switch should be made. Two of the common methods to determine the switch over are as follows:

- depreciation expense for the period is calculated using declining balance method is lesser than the depreciation expense that would have been for the same period if the straight line method was used; or in other words

- the value computed by dividing residual book value (also known as carrying value or net book value) over remaining useful life of the asset is greater than the depreciation expense for the period computed using declining balance method.

Although, this method is not named under International Financial Reporting Standards or specifically IAS 16, but IASs do not restrict the use of methods other than those mentioned in the accounting standards.

Declining balance with cross over to straight line method is used in situations where assets initially render higher benefits but later becomes stable. Another technical reason to use this method is that declining balance method has a basic flaw i.e. declining balance method can never diminish the book value to expected residual value. To get the expected residual value using declining balance method you have to make some technical adjustments which may render either unreasonable depreciation expense for the period when compared to benefits gained in the same period. Most often, if declining balance method is used, last year’s depreciation is the balancing figure to reduce the book value to expected residual value.

Consider the following example to understand how declining balance to straight line cross over method is different from straight line and simple declining balance method.

Example

ABC Ltd. bought an asset at the start of an accounting year costing 100,000. Asset has an expected life of 5 years with a residual value of 8,000

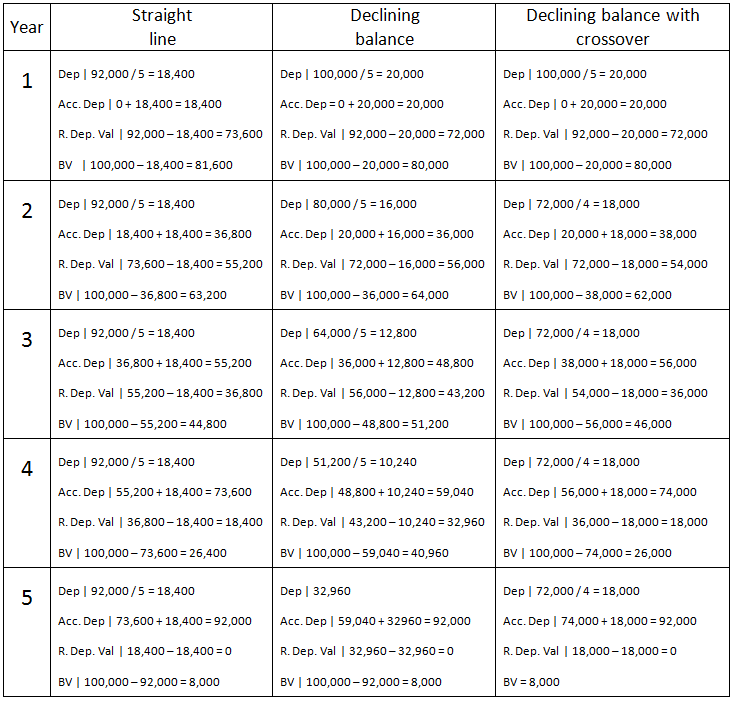

Following is the schedule with depreciation expense over five years computed under three different methods:

Note: Under DBX method the crossover is to be made when depreciation as per straight line is higher then depreciation computed under declining balance method in a given period.

Dep = Depreciation

Acc. Dep = Accumulated depreciation

R. Dep. Val = Remaining depreciable value

BV = Book value or carrying value or net book value

In the above table you can observe the following:

- In the last year of declining balance method, depreciation of 32,960 is simply a balancing figure to reduce the book value down to scrap value of 8,000 and is not computed under the formal method which is followed for computing depreciation for first four years under the same method

- Under Declining balance cross to straight line method, cross over is made in second year as depreciation according to straight line method is 18,400 whereas according to declining balance method it is 16,000.

- On switch to straight line method from declining balance method in second year, depreciation is calculated by dividing remaining depreciable value over remaining useful life of the asset.

table is not showing to me

Error in Declining Balance with Cross Over calculation !!!

In year 3 the Remaining Book Value should be $44,000 instead of 46,000