1 Why throughput accounting?

Well it’s an obvious question that when we already have Absorption and Marginal cost accounting techniques and are helping managers in decision making process why we need yet another? And if we do need then we must first of all know the deficiencies of the older techniques as compared to the new one.

1.1 Traditional techniques – Basic flaw

Here when I will be saying traditional costing techniques then I will mean both absorption and marginal costing. Also to my mind marginal costing is not a modern technique any more as we cannot call it modern just because it came after absorption costing.

In traditional costing methodologies, the emphasis was on maximizing profit WITHOUT considering generation of profit.

1.2 Why it was a flaw? – How this problem got in the seed of traditional techniques

Few hundred years back when manufacturers were far less and a large group of consumer used to depend on these manufacturers. Now small number of manufacturers mean almost no competition at all and this also implies not so many choices to customers as they will have to buy goods from the same manufacturer i.e. Monopoly.

Now, as customers are depending on the manufacturer (instead of manufacturers depending on customers which is a present day situation), manufacturer would have never thought about losing the customers to another manufacturer. Therefore, it was really easy for manufacturer to decide about prices himself without even considering its affect on demand and customers as customers will have to buy from this very person.

Because of this monopolistic economy, manufacturers were not even worried about the cost that they are incurring as they knew that what ever cost they are going to incur they just have to add their desired profit in the total cost and there you have a selling price. This technique of setting prices is called cost plus pricing.

In such economic system, manufacturers had no problems regarding cash flows and they would have never thought their sales are going to decrease due to any reason at all as their sales are promised and they knew their goods will be sold irrespective of price charged.

So, problems of cash generation remained out of the scene until the end of this monopolistic system and the only challenge for the manufacturers was maximization of profit and the simplest solution they had to maximize the profit was: Produce more units to earn more profit!

Or if we make it more precise then it can be summed up as: Produce more and earn more profit by charging higher prices!

1.3 End of monopolistic system – Emergence of new problems

The day manufacturers start getting competitors in the market, the dependency of consumers on just one manufacturer starts getting diluted and slowly and gradually, consumers became aware (market knowledge) that as they have the alternative goods (substitutes) in the market then they can choose between the manufacturer and can buy items from such manufacturer who is offering lesser prices.

Thus a new era of markets started and the system of monopoly starts fading. With every additional manufacturer in the market offering similar items, the market became more and more competitive or in other words consumers started getting more and more choices and ultimately manufacturers were unable to control and decided about the prices on their own

2 Throughput Accounting – A new dimension

After the managers recognized the weaknesses in the traditional techniques, as it was not coping up with the emerging perfectly competitive market i.e. environment of perfect competition, they found old techniques are not helping much in pricing decisions as they were unable to add up the affect of customer’s will to buy products.

This is where a new technique which also considers the affect of customers’ will to buy products. As now we can understand that by merely producing items and having them in the store in the finished goods form does not promise profits. We earn profits ONLY when goods change hands i.e. actual sales take place.

And that is also the meaning of the word throughput. Under this technique we do not emphasize on increasing profit, instead we emphasize on generation of cash inflows by increasing sales which will automatically push profits to increase.

For some this shift might not be of much importance as increasing sales means increasing profit. But it is certainly not the same as when we want to increase the sales we have to deal with lot of other things also which we never even consider while increasing profit.

One possible example is as follows to understand this shift from increasing profit to increasing throughput (sales).

We all can understand that total revenue can be calculated using the equation:

Revenue = Quantity Demanded × Per unit Price

Keeping above equation in mind, if we consider only to increase profit (which was the case in old days) then total Profits can be increased by either increasing the number of units sold OR by increasing per unit profit i.e. by increasing per unit price but that is easily possible only if there is just one manufacturer in the market as customers has no other option.

But in the market where more then one manufacturer are selling the same and then you cannot do either of these easily. Why? Because if you are going to increase the per unit price then customers will switch to other manufacturers as they will be able to buy the same thing at cheaper rates. Therefore, increasing price will not give you more profits as units will decrease. And also, quantity sold cannot be increased if you are not decreasing price as customers need reason to buy things from you.

Thus, we understood that without increasing sales we cannot increase profits. And this is what we did. We changed our preference from increasing profits to increasing sales.

2.1 Theory of Constraints – An intro!

In order to understand Theory of Constraints it will be good if we go back to its source and understand it first hand in words of the developer of this management theory, Dr. Eliyahu M. Goldratt. It is advised to students who want to gain extra insight into this theory should consult The Theory of Constraints and its Thinking Processes: A Brief Introduction to TOC. The white paper can be downloaded from AGI – Goldratt Institute website.

2.1.1 | Problem with old theories

According to researchers at AGI – Goldratt Institute, even today management of different organization is using the rule of “divide and conquer”. Even though this philosophy of management has been good and is still good but it has its problems. And these problems increase as the scale of organization’s processes grow. As the whole organization is divided into different departments and responsibility centers, the management is also scattered and divided and thus each department sometime becomes standalone organization. Due to this problem each department start making its own objectives and targets which might be different from the organizational objectives. Therefore, the whole system fails as the sub-systems are not working collectively as every department is pursuing its own goals because manager of each responsibility center will try to save its own skin. Due to this narrow line of thinking, most of the decisions by manager will be short sighted (short term).

If all the departments start acting in the same manner then departments might win individually (in a short run) but in the end whole organization will collapse.

Thus we understood that the problem lies in the management technique itself which can be translated in total destruction. Because of this we need a new management system that helps in integrated management and automatically promise co-operation between departments.

2.1.2 | Bottlenecks/Constraints/Barriers – Basic idea under TOC

The most obvious question that comes in mind is why managers will try to drift the department away from organizational objectives? Well usually departments do not work at same length not because that one manager dislikes managers in other departments but the real reason might be that one department is limiting the performance of the other department and thus its incentives.

Let’s understand this with one example.

ABC Ltd has two departments; Production department and Sales department. Bonus scheme is in place for both the departments. Bonus of labour force working in Production department is calculated on the basis of time saved whereas bonus for workforce working in Sales department is calculated on the basis of number of units sold.

Now, in the situation presented above, the labour force of production department will try to produce as many units possible in lesser and lesser time to earn more bonus. On the other hand staff at sales department will try to do everything to push sales more and more.

Because, of their own department level objectives, production department will produce units at such rate or in such quantity that sales department might not be able to coup up with. Therefore, idle inventory will start piling up. This inventory that consists of work in process or finished goods is proving no good to organization. Instead organization will bear its handling and storing cost.

On similar tune, sales department will try to make more and more sales which might cause saturation in the market with time and thus per unit price will get hurt.

So, we understood that departments may start acting in isolation and the managers might ignore the big picture they are painting which might shade the organization’s overall “face”.

Therefore, such management technique was needed that enable the management to work collectively and which automatically pull the management out its individual seat and make them work together with unanimous goal i.e. organizational goal and NOT departmental goals by blocking these barriers of individualism. These deviated efforts are barriers to overall business performance.

However, this is just one type of barrier among many others. Other constraints can be:

- Limited demand of the product as market is saturated with substitutes or simple customers are not willing to buy more units at the current price level.

- Capacity of plant is limited for example; machine hours are not more than 3,000 hours in a month.

- Required labour is in limited supply therefore limited amount of raw material can be converted to finished goods

- Nature of the process

- Quantity and quality of raw material available

- Legislations

- Contracts with suppliers

- Policies of the organization (sales only on cash basis)

2.2 Maximizing Throughput under several constraints

So, until now we have covered the ground and we know:

- What to focus to increase our profits

- What might limit our profits

So, now we want to move from this point forward and ask ourselves that with these two things in our mind what should be our game plan. Eliyahu M. Goldratt suggested FIVE Principal points or precisely said plan of action:

- Identify the barriers that are keeping the system to increase its throughput.

- Workout how to manage your inputs and outputs around the bottlenecks in such a way that such resource or activity (that is limiting the whole system) provides maximum benefit.

- Synchronize everything else (resource, activity or departments) according to the decision taken in step 2 so that other activities or departments (other than bottleneck activity or department) are neither inefficient nor over efficient.

To further improve the performance, append the following actions to the above plan:

- Elevate the bottleneck. If this is not easy then try to improve the performance of the bottleneck thus reaping more benefits with the same amount of limited resource.

- If any of the steps taken above moves the constraint then start again from step 1.

2.2.1 Explanation of implications of each step

In Step 1 it is suggested that we have to first identify the barriers or constraints that are limiting our throughput. But identifying all the constraints and their effects is so difficult that it becomes mere assumption that organizations can point out the cause and effect as identifying scarce resources need resources i.e. cost-benefit analysis. Moreover, it might be the case that more than one constraint is active at a given time and thus make the situation so complex that it is hard to understand the exact effect of each and every barrier. Therefore, organizations might find this impossible to adopt right at the first point.

In Step 2 managers need to find out the optimum mix of inputs (including the bottleneck) in such a way that it provides maximum throughput. In simple words, management will try to make such outputs which are giving more by taking less. However, inputs and outputs are hardly under the complete control of the management. We will be dealing with concept of controllability later in more detail.

Step 3 sums the first phase of the action plan suggested by the developer of TOC. The implications of this step are vital and important to be understood both from examination and also from practical point of view.

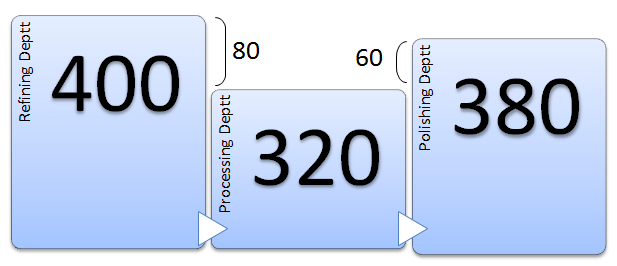

We all understand that one organization can have different departments working together to produce one product. For example: Goldmine Plc produces gold rings. To finish one unit it has to pass through three different departments; Refining, Processing and Polishing.

Refining unit can refine 400 kg of raw material in one month which after refining is sent to processing department. Processing department can process 320 kg of refined raw material which is then sent to Polishing department which can polish 380 kg of processed material received from processing department. The following figure explains the same.

As we can see that processing departments total capacity is less than refining departments output, in this case if refining department refines 400 kgs of material and send all of it to processing department then processing department will not be able to process all the input and thus work in process of 80 units will build up.

Moving further, processing department after finishing processing of 320 kg out of 400 kg will send it to polishing department. From the figure we can see that polishing department can process 380 units but because of small input from processing department and thus will not be able to attain its full potential.

It is evident from the figure how one department can limit the performance of other departments and organization as a whole.

In the short run most of the barriers cannot be overcome and the only solution available in the situation above will be to limit the refining of materials only 320 units. This is a wise idea for two main reasons:

- Work in process that will be built is not brining any cash flow as incomplete units cannot be sold. And still company is incurring cost on them in the form of holding cost. So, it’s a double trouble. It is not only consuming our working capital but also causing loss which might not be recoverable.

- By refining only up to 320 kg we will have spare resources which we can use somewhere else in the organization and also the cash is not jammed up in the inventory.

This is what theory also suggested i.e. synchronize all the activities according to the binding constraint so that everything works at the same pace.

Step 4 is about research and devising new ways and workarounds to elevate bottlenecks. However, it depends on the constraints itself. Some are easy to remove or at least have easy solutions. But some can be difficult to overcome and require resources and creative workforce. And this might take long time to win the fight against bottlenecks.

Lastly, if things are managed in such a way then system will be evolved and will continuously improve itself over time and the only thing that is going to stop the process is the will of the management to change which is common and managers do not like to stay in warm waters for long. As change means risk and this could risk their job as well because this does not take only managers’ continuous inclination towards change but also everybody working under such managers which might not be able to coup with the change.

2.3 How Throughput accounting is different

First of all we must understand that why we call it throughput accounting and not throughput costing. Throughput accounting is neither cost accounting nor costing because it is cash based and does not help in calculating, allocating, apportioning or estimating in any way rather considers majority of the costs as period costs except material cost. Throughput accounting is just another quantitative management technique that supports managers in managing resources. It does not provide any assistance at all for costing purposes.

As we have already discussed that throughput philosophy is different from its predecessor management systems and emphasize on increasing throughput which is rate at which cash inflows are generated through sales. In other words, it is suggesting that outflows should be controlled. According to Goldratt, outflow takes place due to two reasons:

- Purchase of inventory which Goldratt treated as investment as this will ultimately become the reason for inflows after conversion to finished goods.

- Conversion costs which consists of all such costs that organization spend to convert raw inventory not just into finished goods but saleable goods.

Now both of these outflows (material cost + other expenses) must be balanced with the inflows (sales revenue). The performance of the product is measured in two steps:

First by finding the rate at which throughput is generated per limiting factor (also termed as factory hour) and secondly by comparing the rate with other expenses to find out how much of total throughput is utilized towards covering other expenses.

The product with maximum throughput AND with the best coverage of other expenses will maximize the profits.

2.4 Calculation and Interpretation of Throughput Accounting Ratio

As we have repeatedly said that main idea is to maximize throughput keeping the bottlenecks in consideration. If we keep only that resource in mind which is restraining the whole system at one point and then start thinking about what to produce and how much to produce then every manager’s decision will be simply to produce that product which gives the maximum benefit among all the alternatives available.

The selection is sometime easy to make but can be complex if situation involves different variables connected with the production process.

Example 1:

ABC Ltd is planning to introduce new product in the market. The relevant data is given below:

A 90 50 1

B 50 25 1

C 60 40 1

The labour hours are limited to 4,000 hours. If demand of the above products is unlimited, which product is giving maximum throughput?

Solution:

First of all we need to calculate throughput for every product by deducting material cost from sales revenue.

A = 90 – 50 = 40

B = 50 – 25 = 25

C = 60 – 20 = 20

As labour hours are limited to 4000 hours therefore, every hour must be spent on such product which gives the highest pay out for 1 hour. And as we can see above, for one hour A is giving 40 whereas B and C are giving 25 and 20 respectively for each hour spent on producing them. Therefore, A will be the product that must be produced to maximize throughput within 4,000 labour hours.

Example 2:

Steelhead Plc manufactures four different products. But due to limited machine hours, company is no longer able to meet the demand of all four products. In order to decide which product should be preferred in production you are provided with the following data:

Sales price Material cost Operation Exp Time (Minutes)

Magnetite 200 150 90 30

Hematite 450 320 160 45

Geothite 350 150 80 60

Limonite 750 600 400 20

Required:

- If machine hours are limited to 5,000 hours then suggest the production supervisor which product is giving maximum throughput per limiting factor.

- Calculate throughput accounting ratio

Solution (a):

In case where each product is consuming different amount of limiting factor then comparing throughput of each product will not give us accurate results. To make the results more accurate we need to bring all the products at one comparison point which is same for all the products. As in the question each product takes different amount of time to complete. Therefore, first we have to bring the products to any reference point which should be same for all for example 1 hour or 1 minute.

In order to find out how much throughput each product is generating per minute, which is also called RETURN PER FACTORY HOUR, we will divide each product’s throughput over time it takes to finish which is limited.

Magnetite (200 – 150) 150 150/30 5

Hematite (450 – 320) 130 130/45 2.89

Geothite (350 – 150) 200 200/60 3.33

Limonite (750 – 600) 150 150/20 7.5

Limonite is generating the maximum throughput in comparison to other products for every minute spent on making it. It also means that if some other product is selected instead of Limonite then organization will suffer from opportunity loss.

Solution (b):

By going through above examples, now it might be easy for you to understand how different products are compared and how their throughputs are compared. However, only throughput is not enough to make the selection of the product. As said earlier, the product with maximum throughput AND the best coverage of other operating expenses will maximize the profits.

If we continue our calculations in Example 2 and now put the returns against operating costs, we will be in a position to judge which product is covering the other expenses at best, which will give us throughput accounting ratio.

But to make the comparison right against returns, even the costs will be first put against the limiting factor so that rate at which expenses are incurred can be found, which is also termed as cost per factory hour. In simple words, we are comparing the rate of net inflow against the rate of outflow.

Cost per factory hour can be calculated as follows:

Magnetite 90/30 3

Hematite 160/45 3.56

Geothite 80/60 1.33

Limonite 400/20 20

These figures tell us the amount spent towards other expenses for each minute if a particular product is manufactured.

To calculate throughput accounting rate now we simple have to divide return per factory hour over cost per factory hour

5/3 1.67

2.89/3.56 0.81

3.33/1.33 2.5

7.5/20 0.38

Above figures cleared the picture more and made the decision more easy and accurate. An important conclusion that needs attention is that Limonite have maximum throughput and was apparently more attractive, but other expenses to make limonite are so high that its throughput becomes overloaded and thus is the worst product to be chosen. Therefore, goethite is the best and the only profit making product as only geothite’s throughput ratio is above 1 which means that inflow is more than the outflow and all the other products are not generating enough inflows to cover the outflows and thus making loss.